In This Article

Trading is both an exciting and intimidating venture for beginners, yet it may make one feel a bit overwhelmed. Creating a solid trading plan is the key to navigating the unpredictable terrain of the market and enhancing one’s chances of success. It would work as a strategic roadmap and blueprint that guides you through every decision, helps you achieve consistent successes, and keeps you grounded amid volatility.

In this blog post, we will walk you through the eight essential steps to help you create a winning trading plan that empowers you to trade confidently with a purpose. A customized plan that truly works.

Quick Overview

- Educate Yourself: It’s essential to learn the basics and fundamental concepts of trading, such as market trends, technical analysis, and risk management. Then, it would be best to choose a trading style according to your preferences, strategies, and risk tolerance.

- Create a Trading Plan: Defining clear goals and financial objectives is important. To help you achieve those, you need a well-thought-out strategy that aligns with your risk tolerance and trading style.

- Risk Management: Learn to implement stop-loss orders, take-profit orders, and strategically split your investments to limit potential losses while securing profits.

- Practice, practice, practice: Broker accounts usually come with demo accounts, where you use virtual money and implement the trading strategies you have learned. This helps polish your skills without any risks and helps you gain confidence, too.

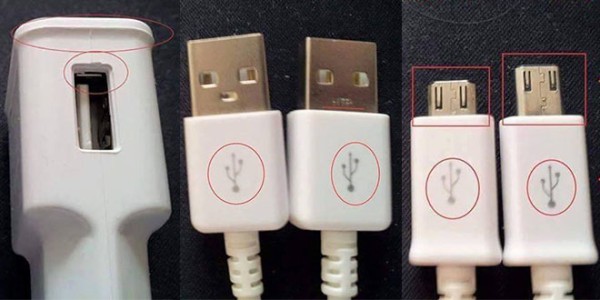

- Choosing a Broker: Look for reputable brokers with good track records, reliable trading platforms, and low fees. You may want to consider the features and tools offered in their platforms that match your trading style.

- Start Small: Once you are confident enough to invest in the market, the best strategy is to start with a small investment to minimize risks. You can then increase your investment as you begin to gain confidence and experience.

- Emotional Control: Maintaining clear plans and goals while avoiding impulsive decisions based on emotions. You need to learn to have the utmost control over fear and greed. Also, learn from your mistakes and continue to work on areas that need improvement.

Let’s discuss in detail the essential trading plans for beginners and how it can help you build a winning trading strategy.

1. Define Clear Goals

Start by establishing your trading objectives and clearly defining your goals. You need to ask yourself questions like, “Do I intend to earn more?” “Do I want to invest for future growth?” “Am I looking to increase my investment portfolios?”

It’s important to ensure your goals are well-defined, clear, and reasonable. This way, you can look back on them and remind yourself why you are trading and what your aim is. Just to give you an idea, rather than stating that “I wish to make some cash,” a better goal can be “I aim to earn a 10% ROI by the end of this year.”

Goals like these not only give you a sense of direction but also work as a target that you need to achieve.

2. Know Your Risk Tolerance

For anyone learning to trade and aiming to enter the market, it is important to determine risk tolerance. The amount of money one is comfortable losing varies from person to person. Hence, it is important to analyze your financial condition, and based on that figure, you can limit the amount you would be comfortable risking with trading.

One of the most widely used rules, or we can say it’s a well-known trading strategy, is the 2% rule. This rule states that you will never risk more than 2 percent of your trading capital on any trade. The strategy helps lessen risk while preserving capital. It also helps you diversify your portfolio by spreading risks across multiple positions and trades.

3. Choose Your Markets and Instruments

With so many markets out there, like stocks, options, forex, and cryptocurrencies, it’s important to focus on the ones that interest you the most. For example, if you’re drawn to forex trading, you’ll want to familiarize yourself with different currency pairs and understand how this type of trading works, especially if you’re interested in forex trading session Malaysia, as they can affect volatility and trading opportunities.

You need to spend some time researching different markets to see which ones you would be more interested in trading in. You can then narrow it down to specific instruments to help you become more knowledgeable about those choices.

4. Develop a Trading Strategy

Your trading strategy is how you plan to enter and exit trades, manage risks, and evaluate your performance and how well you’re doing overall. Here are some key elements to include:

- Technical Analysis: Using charts and indicators to examine price movements and identify trends. Standard tools include moving averages, support, and resistance levels.

- Fundamental Analysis: Keep up with economic news and events that might affect prices. Making informed decisions is possible if only you can see the broader perspective.

- Time Frame: Decide if you want to be a day trader (making quick trades throughout the day), a swing trader (holding positions for several days or weeks), or a long-term investor.

- Entry and Exit Rules: Clearly outline when you will be willing to enter a trade and exit, including your stop-loss and take-profit levels.

5. Create a Risk Management Plan

Managing risk is important so you can stay in the game longer, even if you are at a loss. Here’s what you need to focus on:

- Position Sizing: Decide how much money you’ll put into each trade based on your risk tolerance.

- Stop-Loss Orders: These automatically close a trade if it goes against you, helping to limit your losses.

- Diversification: Do not invest all your funds in a single trade or asset. Wisely spreading your investments can help reduce risk significantly.

6. Keep a Trading Journal

If you want to improve your trading and become a lifelong expert, writing down what you do in a journal could help you keep track of your trades, analyze your performance, and identify areas for improvement.

Certain trading details are important to record in the journal, including, but not limited to, the reasons for taking each trade, its performance, and areas of improvement. You can use this data to see trends in your investments and trades, and reading through your journal every now and then will help improve your plan and strategize for future trades.

7. Monitor and Review Your Performance

Take some time out from your schedule and trade every week or monthly to look at how you’re doing and your performance compared to the goals you had set in the beginning. You may want to ask yourself questions like:

- Am I meeting my profit targets?

- Am I following my risk management rules?

- What’s working, and what isn’t?

This reflection will help you stay on track, make necessary adjustments to your trading plan, and create new strategies to help build a winning trading plan.

8. Stay Educated and Flexible

Given that the trading markets are never static, one must continue educating and gathering knowledge to improve skills. To remain updated and thrive in the ever-evolving market, you need to commit to continuous learning and polish your skills by reading insightful literature, enrolling in online courses, and networking with other seasoned traders.

With every knowledge you gain and every new connection you make in the trading industry, you will gain fresh information that will give you an edge over others while helping you adjust your trading strategy to make more competent and more confident decisions as you learn and gain more experience.

Concluding Thoughts

Having a powerful and well-crafted trading plan that works for you doesn’t have to be complex. The simpler the trading plan, the more achievable it will be, as you can set clear goals, understand your risk tolerance, choose the right markets, and develop a solid strategy.

It should be remembered that trading requires patience, discipline, and emotional control. If you have taken the time to think through your trading plan well, you will have a much better chance of moving through the market safely and controlled while achieving your financial objectives.