In This Article

Many business owners aspire to financial freedom, but few truly achieve it. The most crucial part is managing business finances effectively; however, it can be challenging without access to the right resources.

Thankfully, modern technology offers solutions like free business accounting software, which can help simplify financial management, automate bookkeeping tasks, provide real-time updates for cash flow, and even gain insights into financial performance, particularly for Android users.

Whether you’re an entrepreneur or a small business owner, this blog post will help you take control of your business finances today and set you on a solid path toward achieving financial freedom. We will explore why financial freedom matters and the role of accounting apps, and we will also reveal the best free accounting app for Android.

Quick Overview

Here is a quick overview of how Android business accounting and invoicing apps can help you streamline the process and gain real-time insights into finances and cash flow.

Gain Financial Awareness About Your Business:

- Real-Time Tracking: Whether you want to monitor income or expenses, accounting apps allow you to track your finances in real-time so you can instantly know the financial health of your business.

- Manage Cash Flow: Knowing your cash flow lets you make intelligent financial decisions related to planning investments and spending and ultimately set yourself up for financial success.

- Boost Profitability: Get a bird’ s-eye view of your profit and loss statements. This helps you analyze and make informed decisions on cost-cutting and improve your bottom line, driving your business toward greater profitability.

Make Smarter Decisions:

- Data-Driven Insights: The apps can generate financial reports and analytics, which you can use to harness the power of data. Helping you gain clarity to make informed decisions that drive your business forward.

- Forecasting with Predictive Analysis: Some accounting apps offer forecasting and predictive analysis that give insights into future financial trends based on the provided data.

- Proactive Risk Management: Quickly identify any potential financial risks before they weigh you down. Enabling you to take proactive measures to protect your business.

Become Efficient and Improve Productivity:

- Automate Tracking and Reporting: Say goodbye to tedious accounting tasks. With automation, you can automate tasks like invoicing, expense tracking, and bank reconciliations, saving time and shifting your focus on what matters.

- On-The-Go Access: The mobile app allows you to access your finances with a few taps. Whether traveling or between meetings, you can manage your accounts and keep your business finances running smoothly.

- Less Chances of Error: With all the records completely digitized and automated, you will immediately reduce the risk of errors. These accounting apps ensure accuracy, so you can always trust the accuracy of your financial data.

Better Control of Your Finances

- Unified System for your Data: With all your critical financial information stored in one secure, easy-to-access location, this ultimately simplifies management and enhances your ability to protect your financial data.

- Secure Access: Accounting apps have top-notch security features, ensuring your financial information is safe.

- Simplify Taxation: Filing your taxes doesn’t have to be stressful. Thanks to the data stored within these apps, you can stay organized throughout the year, so you’re always ready when the time comes.

Top Free Business Accounting Apps for Android

Choosing the perfect accounting app for your business isn’t just about balancing the books – it’s about finding a tool that fits your unique needs, can be scaled along with your growing business, and stays within your budget.

Whether you’re a startup or a small business, these top-rated free accounting apps have got you covered in managing your finances.

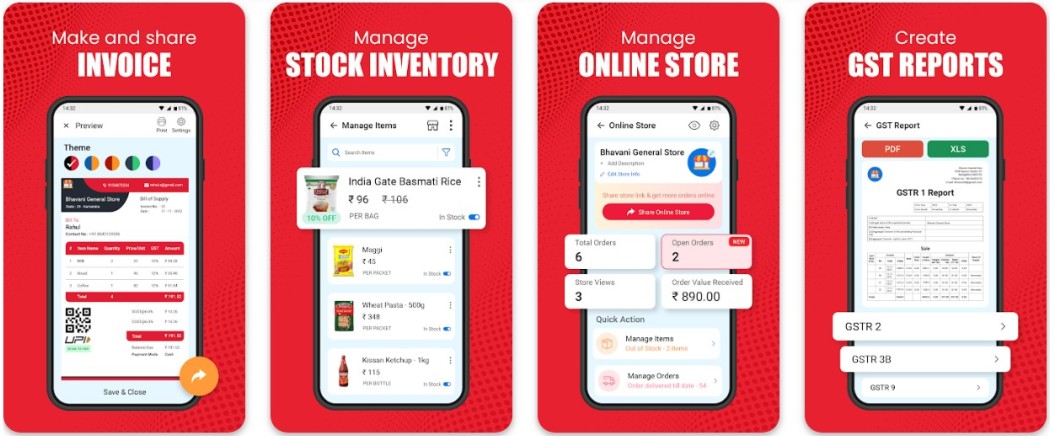

1. Vyapar

Vyapar is one of the top free billing and invoicing solutions for businesses. It is well-known for its exceptional user experience, as it transforms the way you handle billing directly from your Android phone.

Regardless of the size and type of your business, Vyapar is your go-to solution as it will help streamline the billing process while authorizing you to create professional invoices along with the capability to manage inventory, generate GST-compliant e-invoices, and track all expenses.

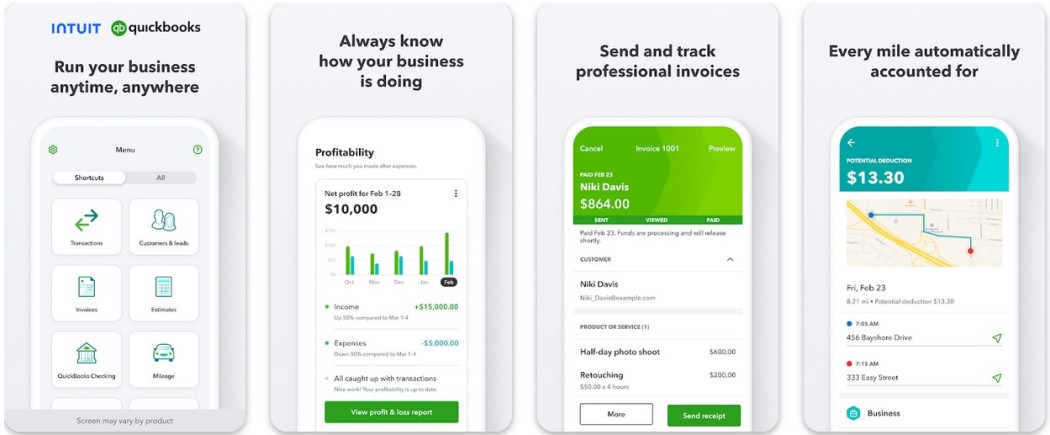

2. QuickBooks Online Accounting

A popular choice for small and growing businesses, QuickBooks offers features such as invoicing, expense tracking, and real-time financial insights. You can completely transform your business with its all-in-one solution designed to fit your business needs with the capability to boost growth.

The app helps you easily manage your finances, manage cash flow, and track expenses directly from your phone. You can manage tax deductions with automated mileage tracking and get paid faster with professionally designed invoices and estimates.

Download: https://play.google.com/store/apps/details?id=com.intuit.quickbooks

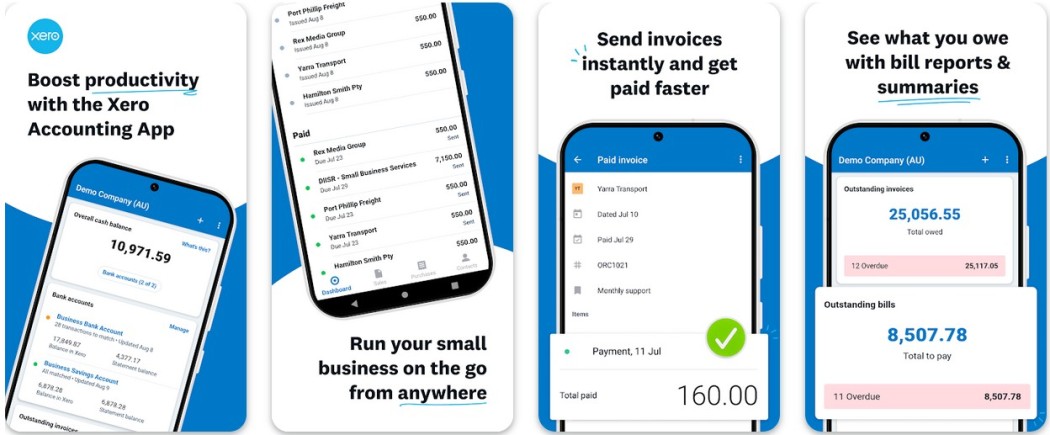

3. Xero Accounting

Boost your productivity with the Xero Accounting app for Android, as it empowers you to run your business on the go, no matter where you are. Whether you want to track cash flow, manage your expenses, or looking to send invoices, Xero will help you in every stage of financial management.

You can directly integrate all your finances and data with your Xero account, giving you real-time insight into your income and expenses. The intuitive Android app allows you to reconcile your finances on the go quickly.

Download: https://play.google.com/store/apps/details?id=com.xero.touch

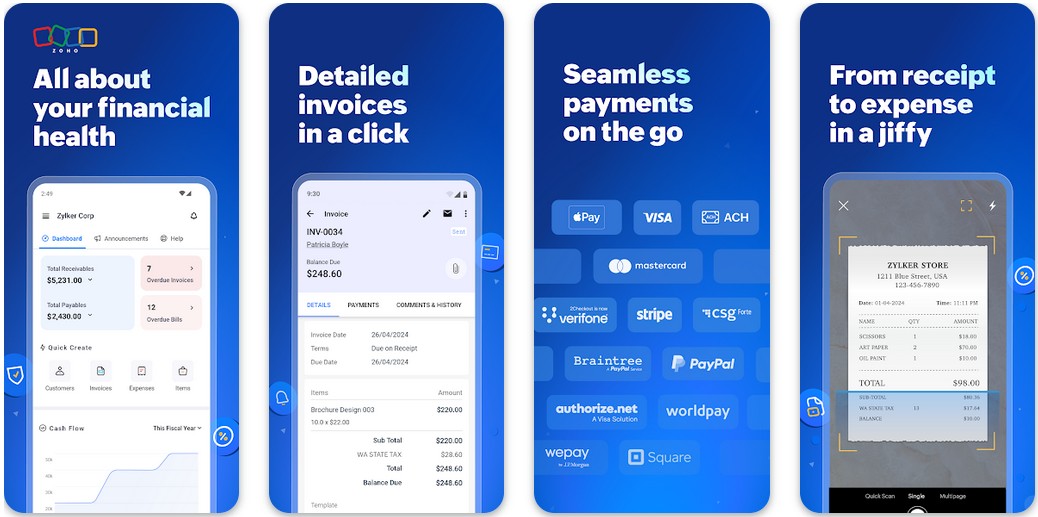

4. Zoho Books

Whether for inventory management, invoicing, time tracking, or expense tracking, Zoho Books offers a comprehensive solution for effortless financial management. Thus, you can always stay one step ahead with your finances and be well aware of your financial health.

Zoho Books works as your personal accountant, and it can seamlessly integrate with the rest of your team, even with your financial advisor, so they can remotely review your finances and enlighten you with expert guidance without any delay. Moreover, the app offers customizable invoice templates that you can personalize to reflect your brand.

Download: https://play.google.com/store/apps/details?id=com.zoho.books

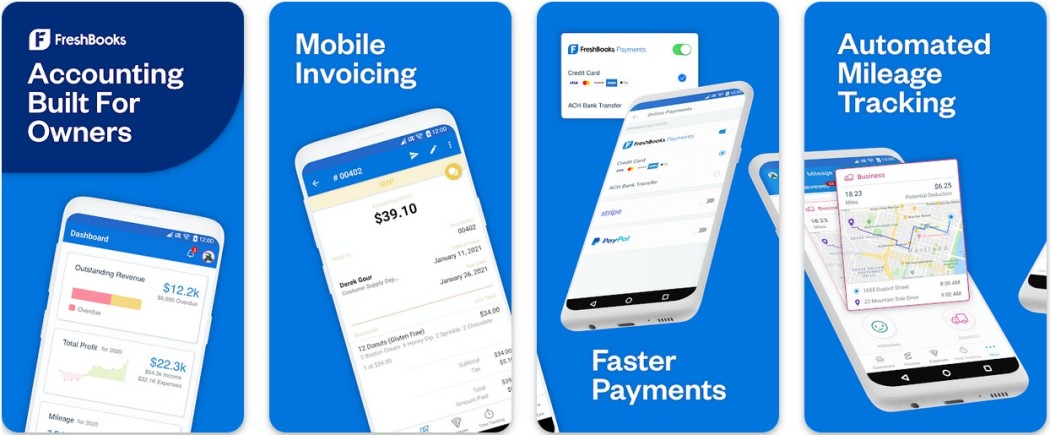

5. FreshBooks Invoicing App

Unlock your business’s true potential with FreshBooks, one of Android’s best and most well-known invoicing and expense-tracking apps. It lets you effortlessly manage your business finances as you streamline your bookkeeping, generate invoices, track expenses, and keep track of time, all of which ultimately boost your business’s overall efficiency.

FreshBooks is designed for business owners as it allows you to generate professional invoices that leave a lasting impression on your clients, keeps a real-time record of expenses by actively syncing transactions with your bank, with time tracking your team can log time, which then adds billable hours to the invoice, and the easy-to-understand report gives you an authentic overview on your business’s financial health.

Download: https://play.google.com/store/apps/details?id=com.freshbooks.andromeda

Key Features and Benefits of Using Accounting Software

When choosing business accounting software, you should consider features like ease of use, expense tracking, budgeting tools, invoicing, report generation, and security measures. Reputable software should give a comprehensive view of your finances at any given moment.

User-Friendly Interface

The app needs an intuitive design and is user-friendly for everyone, regardless of their tech skills. The layout should be clean so you can effortlessly access all the essential tools and features, making accounting simple and hassle-free.

Expense Tracking

The accounting app should have income and expense tracking capabilities, which help you easily categorize transactions, set up recurring expenses, and capture receipts – all in one place to stay on top of your finances, as well as inflow and outflow.

Budgeting Tools

An important feature is that it helps you set weekly, monthly, and yearly budgets and tracks your progress. You can also set up alerts that notify you whenever you approach your set limits. All of this combined always assists you in staying on track.

Report Generation

Financial reports provide you with detailed insights about the overall health of your finances and highlight your spending habits. You can even export these reports to analyze your business finances further.

Security and Safety Measures

Security and safety features are essential to protect your financial information. The features include data encryption, 2FA login, and regular backups.

Tips to Get the Most Out of Accounting Apps

Regularly Update Your Transactions

Update your transactions regularly to get the most out of the accounting software. This ensures your financial data is accurate and up-to-date, giving you a clear picture of your financial health.

Utilize Budgeting Tools

Set realistic budgets, track your progress, and adjust as needed to fully utilize the software’s budgeting tools. These tools are invaluable for maintaining financial discipline and achieving financial goals.

Review Reports Frequently

Make it a habit to regularly review the financial reports generated by the software. These reports provide valuable insights into your spending habits and financial health, helping you make informed decisions and adjustments.

Secure Your Financial Data

Ensure your financial data is secure using strong passwords, enable two-factor authentication, and regularly back up your data. The software offers all these security measures to help protect your financial information.

Why Financial Freedom Matters in Business

Benefits of Financial Freedom

Financial freedom isn’t just about money but peace of mind. It allows you to focus on growing your business without any financial stress. With enough savings, smart investments, and liquid cash for emergencies, you can confidently pursue opportunities and achieve sustainable success.

Helps Overcome Common Financial Barriers

Debt, insufficient savings, poor budgeting, and limited financial knowledge often hinder financial freedom. These hindrances may seem overwhelming, but you can dominate the finances with the right apps and strategies. Understanding these challenges is the first step toward gaining control of your business’ successful financial future.

Why Is It Important to Track All the Finances

Keeping track of your business income and expenses is essential for your financial health and gaining financial freedom. Proper tracking and monitoring allow you to understand your business expenses, identify spending patterns, and make informed decisions. This is where the business accounting app offers a simplified and convenient way to manage your finances.

Concluding Thoughts

Achieving financial freedom is a journey. However, with the right tools, this journey can become smooth and rewarding as it helps you effectively manage your finances. The best free accounting apps for Android that we have reviewed in this blog post offer a comprehensive and user-friendly solution for Android users to take control of their finances. By utilizing the advanced features and following the valuable expert tips in this article, you can step into a life free from financial struggles.